Frequently Asked Question

Here are some handy situations and questions that are good to know as you grow your Young Living business.

1

How can I qualify for commissions and bonuses?

To qualify for commission compensation under the Compensation Plan, you must have purchased product within the last 12 months and be in compliance with the Agreement with no holds on your member account. Commissions will be paid in accordance with the Compensation Plan, the current version of which is available through the Virtual Office. Commission amounts under US$25 or equivalent in Ringgit Malaysia will not be issued as a check but retained as a credit on account for future product purchases.

2

Why the commission I received is lesser?

Adjustments will be made to your commission check for any processing fees, unpaid balances, or debts owed for other services. When a product is returned to Young Living for a refund or is repurchased by Young Living, the bonuses and commissions attributable to the returned or repurchased product(s) will be deducted from any future commission checks, including that of the upline.

3

Who I can refer to if I want to check on change of PV/missing bonus/or wrong amount paid on commission checks?

For any inquiries with regards to change of PV/missing bonus/or wrong amount paid on commission checks, kindly send email to resolutions@YoungLiving.com.

4

Can I bank in my commission into a different beneficiary bank?

No. The registered bank information will be matched with the beneficiary’s identity card number or company registration number by the bank during the commission remittance process. Details that are incorrect or do not match will result in the bank rejecting the transfer and a delay in receiving the commission.

5

Can I amend the bank details at any time?

It is advisable to NOT amend the bank details once you have submitted the details. If this cannot be avoided, we would recommend that you make the changes before the 10th of the month.

Any information updated after the 10th will be reflected in the next commission payout.

6

Once I have enrolled for Direct Deposit in VO, when can I expect the commission to be transferred?

Pay check for the preceding month’s commission will be processed by the 18th of the month. For commission earnings above RM105:

- If DD enrollment is BEFORE the 10th of the month (e.g., 7 Nov), the preceding month’s (i.e., Oct) commission will be banked into the registered bank account in the same month (latest by 18 Nov)

- If DD enrollment is AFTER the 10th of the month (e.g., 17 Nov), current month’s (i.e., Nov) commission will be banked into the registered bank account in the following month (latest by 18 Dec).

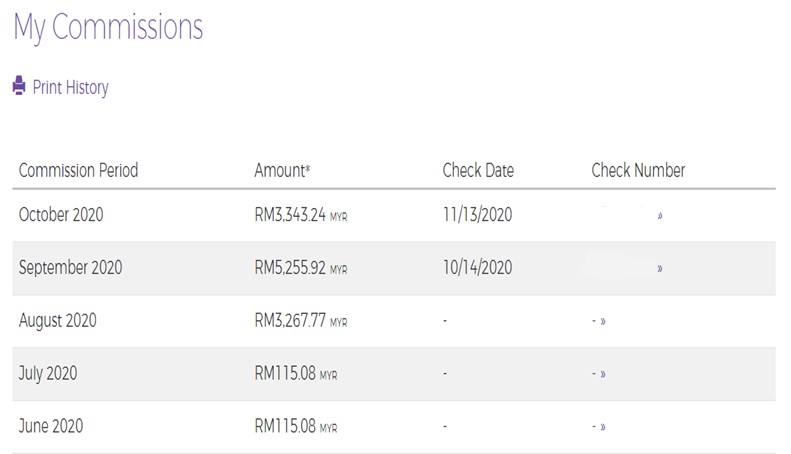

For commission to be banked into registered bank account, a check number will be indicated next to the commission statement in VO.

7

Once the enrollment has been completed, will I receive all the commissions that I earned?

No, only the commission during the enrollment month (updated before the 10th of the month) will be transferred. To encash prior month’s commission, kindly go to this JotForm link https://form.jotform.com/202009069350043, fill in the form to apply for prior month’s commission zeroization. Only commission earned that is more than RM105 will be transferred. Earnings less than RM105 will remain as credit in your YL account that can be used for your next purchase.

Do allow up to 8 weeks for the zeroization to be processed once your JotForm is submitted. While pending zeroization, you can utilize your commission/credit in your YL account to make your YL purchase.

8

I had been receiving my commission via Direct Deposit in the past. However, my current month’s commission (with amount above RM105) remains as credit in my YL account. Why?

Kindly email custservmy@youngliving.com for further assistance.

9

I received email from MS team that my commission has been rejected due to invalid individual ID. I have update the JF in VO, but why I still yet to receive my commission?

Procedures of invalid individual ID correction:

- Apart from updating correct ID in VO, members also need to directly drop email to accountupdates@youngliving.com on the change.

- Account updates team will review and update ID before 10th of following month and inform local Finance once ID are corrected for re-attempt payment.

- Member with commission payment declined due to rejected ID will receive their commission by 15th of the following month.

10

Form CP58 – Statement of Monetary & Non-Monetary Incentive Payment to Agent, Dealer or Distributor.

Who will receive?

- CP58 will be issued to brand partners with monetary (e.g. commission) and non-monetary (e.g. trips, travel voucher, products) incentive payment exceeding RM5,000 per annum.

- Brand partners who has annual earning less than RM5000 and wish to receive a copy of his/ her CP58, may send in the request via Jotform (https://form.jotform.com/MemberServiceMY/CP58). The link will be valid till end of June every year.

When will I get my CP58 form?

- All CP58 forms will be emailed to eligible brand partners by 31 March every year.

11

Section 107D – 2% With-holding Tax on commission (effective from 01/01/2022)

Applicable to who?

- Applicable only to member who is Malaysia tax resident individual, sole proprietor or individual partner in a partnership, who received more than RM100,000 total annual income from YL Malaysia in the immediately preceding year of assessment (For example : the immediately preceding year of assessment for year 2022 is referring to year 2021).

- Entity set up under Sdn Bhd and PLT (Perkongsian Liability Terhad) is excluded.

What kind of income is subject to 2% With-holding Tax deduction?

- All types of payment, cash and non-cash, such as commissions and incentives received by members.

How this tax deduction work?

- For members who are subject to WHT deduction in a particular year, YL Malaysia will deduct 2% from member’s monthly commission income and remit the tax collected to IRB within 30 days.

- This tax deducted throughout the year will be reported in CP58. Member can later claim this tax collected upon filing of Annual Tax Return.

Does member need to have an income tax number?

- Yes, for IRB to credit the amount collected in the individual tax account. Member without an income tax number may register through e-Daftar in MyTax (hasil.gov.my)

Will I be getting any tax remittance receipt?

- IRB no longer issuing individual receipt for tax submitted from July 2022 onwards.

- Amount deducted throughout the year will be reported in CP58. Members can also refer the tax deduction in LHDN website MyTax (hasil.gov.my) under individual account

Will I continue to subject to tax deduction from my income in future years?

- The preceding year RM100,000 threshold value is to be tested each year (not on a one-off basis).